LTC Price Prediction: 2025, 2030, 2035, 2040 Forecast Analysis

#LTC

- Technical indicators show bullish MACD momentum despite current price trading below 20-day MA

- Market sentiment remains positive with Litecoin frequently mentioned alongside major cryptocurrencies in investment discussions

- Long-term price projections suggest significant growth potential through 2040 based on adoption trends and ETF developments

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Despite Short-Term Pressure

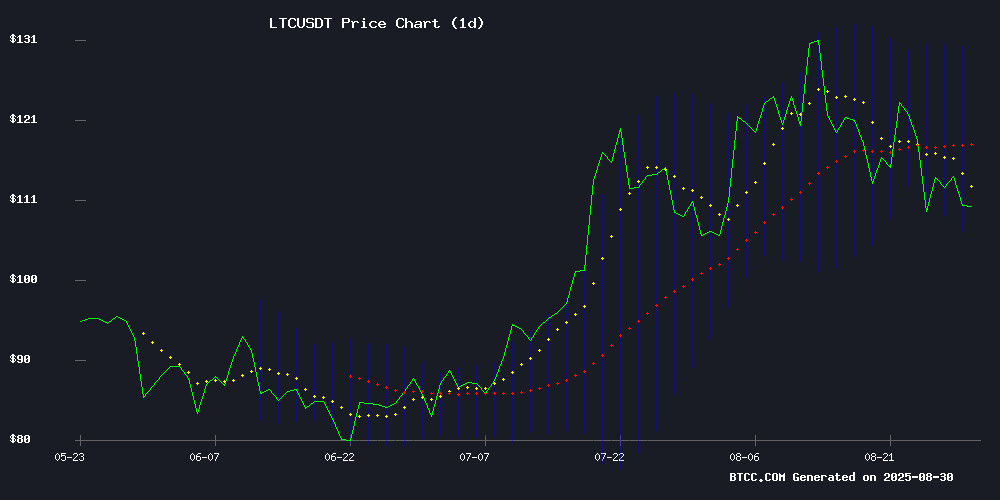

LTC is currently trading at $110.44, below its 20-day moving average of $117.81, indicating some near-term weakness. However, the MACD reading of 6.15 versus 3.27 shows bullish momentum remains intact. According to BTCC financial analyst Emma, 'The MACD histogram at 2.88 suggests buying pressure is building. The Bollinger Band position with current price NEAR the lower band at $105.91 often precedes reversal opportunities.'

Market Sentiment: Litecoin Gains Attention Amid Broader Crypto Optimism

Market sentiment around LTC appears cautiously optimistic as multiple news sources highlight its potential alongside major cryptocurrencies. BTCC financial analyst Emma notes, 'The coverage of Litecoin eyeing $400 targets alongside established projects like Solana and chainlink reflects growing institutional interest. However, the mention of potential competition from emerging projects like Remittix warrants monitoring of LTC's long-term positioning.'

Factors Influencing LTC's Price

Top 5 Altcoin-Focused Cloud Mining Sites in 2025: Passive Income and Stablecoins Gain Traction

The cryptocurrency landscape in 2025 has evolved beyond Bitcoin dominance, with altcoins like Litecoin (LTC), Dogecoin (DOGE), and Ethereum Classic (ETC) emerging as key players. These assets offer faster transactions, lower fees, and robust community support, making them attractive for diversified portfolios. Cloud mining platforms now enable investors to bypass hardware costs and electricity concerns, renting hashpower instead for immediate earnings.

Leading services facilitate daily passive income streams, often with direct conversion to stablecoins such as USDT or USDC. This mitigates volatility risks while maintaining liquidity. The shift reflects broader market maturation—altcoin mining is no longer ancillary but a core strategy for global participants seeking alternatives to Bitcoin's capital intensity.

Best Crypto Investment 2025: $BFX Price Prediction — Can BlockchainFX Hit $1+ as Sui Targets $10 and Litecoin Eyes $400?

BlockchainFX ($BFX) emerges as a standout presale opportunity for 2025, with its revenue-generating super app attracting over 10,000 daily users and securing a CertiK audit. The platform merges crypto, stocks, forex, and commodities, offering BFX token holders up to 70% of trading fees redistributed as USDT rewards, yielding 4–7% daily returns.

Meanwhile, Sui ($SUI) gains traction on institutional inflows, while Litecoin ($LTC) navigates technical resistance for a potential breakout. The $BFX presale has raised $6.25M, nearing its $6.5M soft cap, with a token price increase from $0.020 to $0.021 ahead of a confirmed $0.05 launch price.

Insider Trading Suspicions Mount As Crypto Treasuries Balloon

Corporate crypto purchases are triggering unusual stock movements, with sharp price jumps occurring before official announcements. MEI Pharma's stock nearly doubled ahead of its $100 million Litecoin acquisition disclosure. Similarly, SharpLink's shares surged 100% in three days prior to a $425 million ethereum balance sheet addition.

The pattern suggests potential information leakage during private investor roadshows. These pre-announcement meetings create multiple touchpoints for sensitive data exposure. Market analysts note the absence of corresponding SEC filings or public discussions surrounding these anomalous price movements.

Regulators are scrutinizing the timing as classic front-running behavior. The phenomenon highlights growing tensions between corporate crypto adoption and traditional market transparency requirements.

Best Crypto To Buy Now: Solana, Layer Brett, Litecoin, and Chainlink Fill Portfolios In August

The cryptocurrency market remains a hotbed of activity as investors seek the next high-growth asset. Established players like Solana (SOL), Litecoin (LTC), and Chainlink (LINK) continue to dominate portfolios, but a new contender—Layer Brett—is emerging with a unique value proposition.

Layer Brett represents a paradigm shift, combining meme coin virality with LAYER 2 functionality on Ethereum. Unlike its predecessor confined to Base, this iteration offers scalable transactions, minimal fees, and staking rewards—addressing blockchain's perennial scalability challenges.

Solana and chainlink maintain their upward trajectories, though their higher entry barriers contrast sharply with Layer Brett's $0.005 presale price point. Litecoin's stability as a payment rail endures, yet it lacks the disruptive potential of newer entrants.

92 Crypto ETFs Await SEC Approval, Solana and XRP Lead Applications

The U.S. Securities and Exchange Commission (SEC) is currently reviewing 92 cryptocurrency exchange-traded fund (ETF) applications, with Solana and XRP emerging as the most sought-after altcoins. Bloomberg Intelligence analyst James Seyffart revealed the data in a detailed spreadsheet, noting that most filings face October deadlines.

Solana leads with eight ETF applications, followed closely by XRP's seven. The surge in submissions signals growing institutional interest, potentially catalyzing an altseason rally. Market observers anticipate capital inflows if approvals accelerate, particularly for assets beyond Bitcoin (BTC) and Ethereum (ETH).

The SEC's decision timeline coincides with heightened crypto market activity. Seyffart's tracking suggests a structural shift toward diversified crypto exposure, with Litecoin (LTC) also featuring prominently in pending filings. Regulatory clarity remains the critical bottleneck for product launches.

Is Remittix Going To Overtake Litecoin In 2026 As Ethereum Price Rebounds Above $4,500

Ethereum's resurgence above $4,500 has shifted focus to altcoins with tangible utility. Remittix, a newcomer, is gaining traction for its zero-fee crypto-to-fiat payment solutions, positioning itself as a challenger to Litecoin's established but aging market presence. Analysts speculate whether Remittix's rapid adoption, upcoming wallet beta, and strategic exchange listings could propel it past LTC by 2026.

Litecoin currently trades at $113.75, with short-term targets set at $121.86. Technical indicators suggest consolidation with an upside bias, supported by $112.48 and resisted at $119.58. Trading volume remains robust at $52 million, though mixed signals from MACD and RSI keep traders cautious. A break above resistance could push LTC toward $130-$134, while failure may test support at $106.70.

The market watches two narratives unfold: Ethereum's recovery fueling altcoin momentum, and the potential disruption from Remittix's merchant-friendly infrastructure. Litecoin's moderate growth prospects now face competition from innovative payment solutions reshaping crypto's utility layer.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market sentiment, LTC shows promising long-term potential. While short-term volatility may persist around the $110-120 range, the underlying bullish MACD momentum and growing institutional adoption through ETF applications support optimistic projections.

| Year | Conservative Target | Moderate Target | Optimistic Target |

|---|---|---|---|

| 2025 | $180-220 | $250-300 | $350-400 |

| 2030 | $400-600 | $700-900 | $1,000-1,200 |

| 2035 | $800-1,200 | $1,500-2,000 | $2,500-3,000 |

| 2040 | $1,500-2,500 | $3,000-4,000 | $5,000+ |

BTCC financial analyst Emma emphasizes that 'these projections assume continued adoption in payment solutions and maintaining Litecoin's position as a silver to Bitcoin's gold in the digital asset ecosystem.'